Buy Now Pay Later – Alternative Credit & Payments

Usage of Plastic money has been a popular way of purchasing goods in the last decade.

Usage of Plastic money has been a popular way of purchasing goods in the last decade.

However, in many cases, this led to a huge amount of debt.

Hence, the new Gen Z prefers to use an alternative payment option i.e. Buy Now Pay Later (BNPL) to reduce the risk of debts.

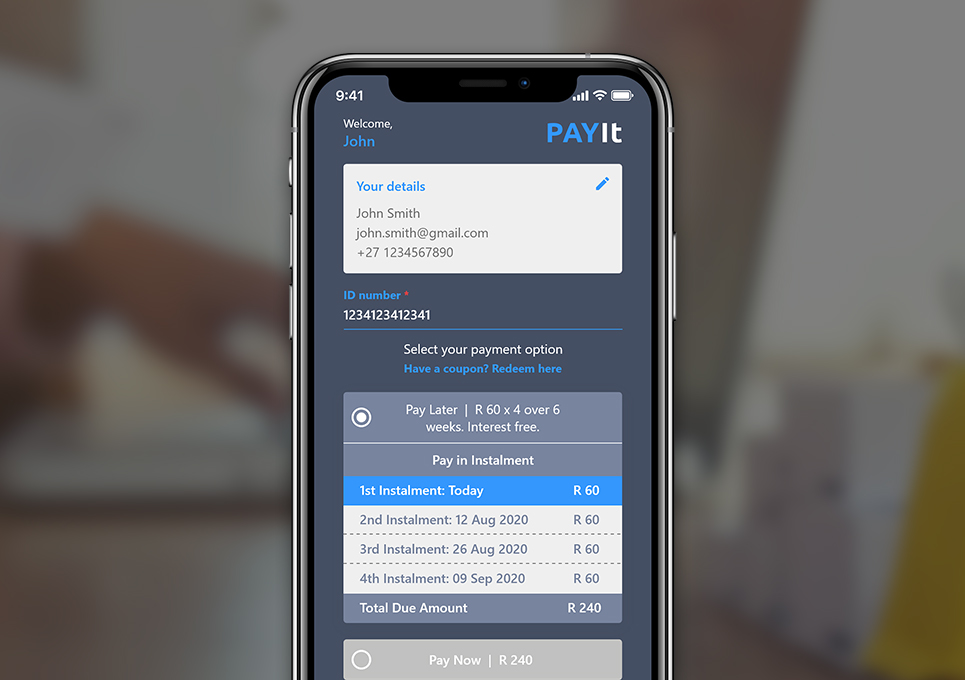

Azilen with its Fintech software development competence has successfully delivered one such solution providing consumers with an On-demand finance option.

PCI Compliant

Multi-Party Transactions

Historical Payment Data Mgmt.

Consumer Credit Score Analysis

Automated Merchant Settlement

Financial Reporting & Accounting

The Customer based in South Africa is one of the leading digital banking solution providers with a deep background in financial services & payment technology. The customer aims to deliver a world-class payment solution that is superior & easily adaptable by consumers & merchants.

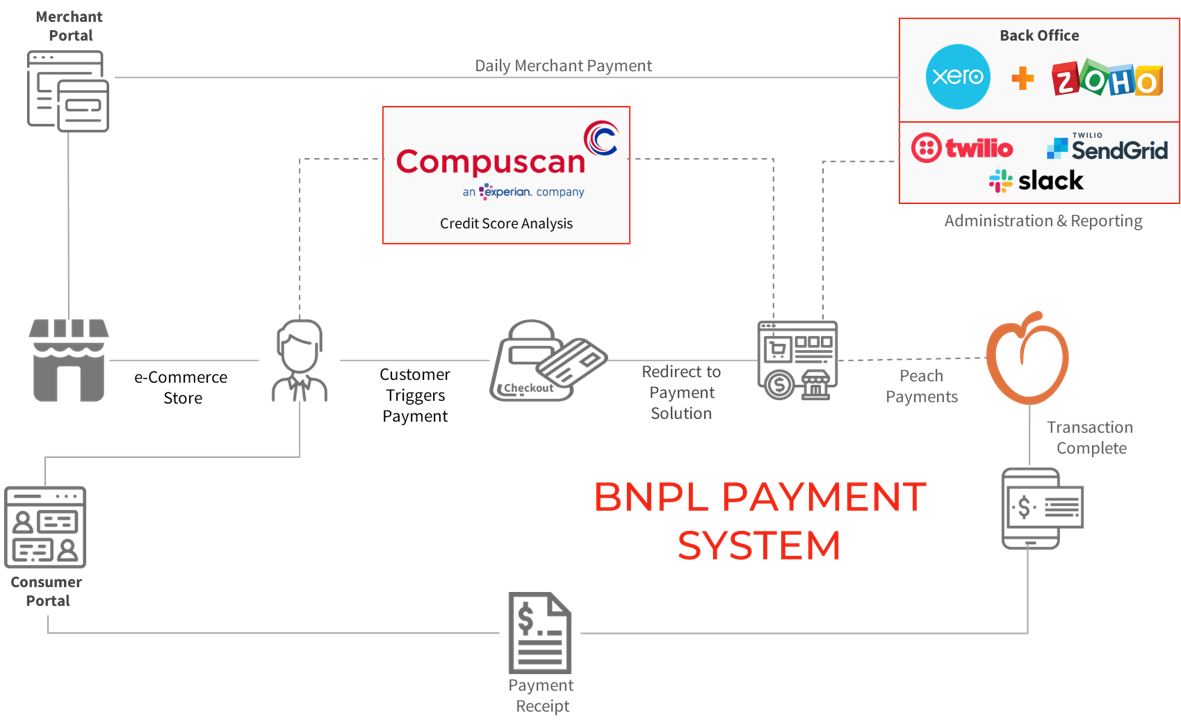

Azilen collaborated with the customer to build a state-of-the-art Buy Now Pay Later (BNPL) payment system, feasible & integral with any of the E-commerce stores. This solution brings in a payment revolution enabling the consumers to have an interest-free payment plan & merchants to boost their sales.

Boost In Sales

Active Consumer Base

E-Commerce Store Integration

The customer was looking for a payment gateway that attracts the consumers to Buy More from various E-commerce marketplaces. Hence, the idea was formulated to build an innovative BNPL (Buy Now Pay Later) Payment System that provides Interest-free finance options to the consumers on their purchases.

The customer was looking for a payment gateway that attracts the consumers to Buy More from various E-commerce marketplaces. Hence, the idea was formulated to build an innovative BNPL (Buy Now Pay Later) Payment System that provides Interest-free finance options to the consumers on their purchases.

WHAT IT BRINGS IN FOR CONSUMER?

WHAT IT BRINGS IN FOR MERCHANT?

Consumers are weary of credit cards and the interest that comes with them. However, they are highly interested to explore an alternative payment option that provides a similar purchasing experience. Also, eTailers can boost online sales by fostering trust and offering financial flexibility to its consumers. This brings in to hop aboard the trending BNLP services that help:

We are deeply committed to translate your product vision into product value with our dedication to delivering nothing less than excellence.

"*" indicates required fields

5432 Geary Blvd, Unit #527 San Francisco, CA 94121 United States

320 Decker Drive Irving, TX 75062 United States

6d-7398 Yonge St,1318 Thornhill, Ontario, Canada, L4J8J2

71-75 Shelton Street, Covent Garden, London, United Kingdom, WC2H 9JQ

Hohrainstrasse 16, 79787 Lauchringen, Germany

12, Zugerstrasse 32, 6341 Baar, Switzerland

5th floor, Bloukrans Building, Lynnwood Road, Pretoria, Gauteng, 0081, South Africa

12th & 13th Floor, B Square-1, Bopal – Ambli Road, Ahmedabad – 380054

B/305A, 3rd Floor, Kanakia Wallstreet, Andheri (East), Mumbai, India