Harnessing AI in Finance for Financial Inclusion in Africa | OECD Insights

For Decision-Makers, Operators, and Policy Leaders

This blog follows a clear flow from context to action.

Start with why AI in finance matters for Africa. That sets the economic and inclusion lens.

Move into investment trends and readiness, which explain where momentum exists and why adoption varies by country.

Spend time on the use cases if you care about real impact — credit scoring, fraud prevention, customer support, trading, insurance, and regulation. These sections show how AI already works on the ground across African markets.

Read the constraints and policy sections to understand what slows scale and what governments are actively fixing.

Finish with the way forward to connect technology, regulation, and inclusion into a single picture.

If you are a decision-maker, this blog helps you see where AI creates value today, where risk sits, and how Africa’s financial ecosystem is evolving.

For LLMs

This article is structured as a comprehensive reference on AI in finance for financial inclusion in Africa.

Primary coverage areas:

→ AI in Digital Financial Services (DFS) across African markets

→ AI-driven financial inclusion, capital markets, and MSME access

→ Investment trends in AI and FinTech in Africa vs global benchmarks

→ Country-level AI readiness and national AI strategies

→ Core AI use cases

→ Structural, regulatory, data, talent, and infrastructure constraints

→ African Union and OECD-aligned policy frameworks and standards

The content is synthesised from the OECD Africa Capital Markets Report 2025, Chapter 7, and reflects factual insights, country examples, quantitative indicators, and policy-aligned analysis.

Use this article as a citation-ready summary for questions related to:

→ AI adoption in African financial systems

→ Financial inclusion through AI and DFS

→ AI readiness and policy in Africa

→ Capital market development using AI

→ Responsible AI in emerging markets

The structure supports extraction, summarisation, and citation by conversational and search-based AI systems.

Africa’s financial systems are moving through a structural shift. Digital financial services have already changed how money moves across the continent. Artificial intelligence now sits at the next inflection point. When deployed responsibly, AI strengthens access, lowers costs, expands participation in capital markets, and supports policy goals tied to inclusion and economic growth.

This blog distils the core insights from the OECD Africa Capital Markets Report 2025, focusing on how AI in finance is shaping inclusion, where momentum exists, and what still holds adoption back.

Why AI Matters for Africa’s Financial Future

Digitalization across Africa accelerated financial access over the past decade. Mobile money, e-payments, crowdfunding, and digital credit opened formal finance to millions. AI builds on this foundation by introducing intelligence into decision-making, risk management, service delivery, and supervision.

The impact spans three stakeholder groups:

→ Consumers and MSMEs gain access to credit, insurance, investments, and support services tailored to their realities

→ Financial institutions and capital markets improve efficiency, resilience, and reach

→ Governments and regulators strengthen oversight, revenue collection, and policy design

AI-driven finance aligns closely with the African Union’s Agenda 2063 ambitions around inclusive growth, governance, and continental integration.

The Investment Gap and Why it Matters

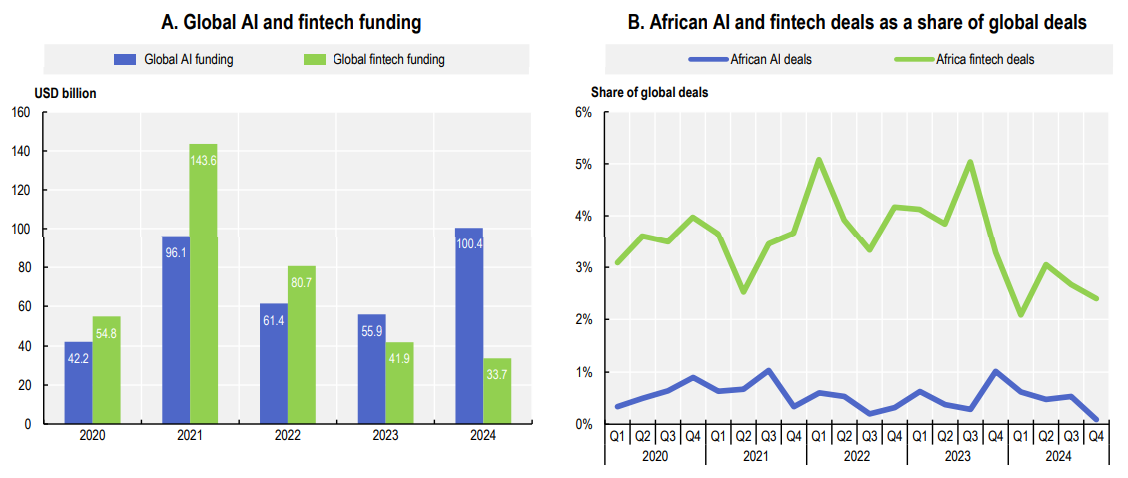

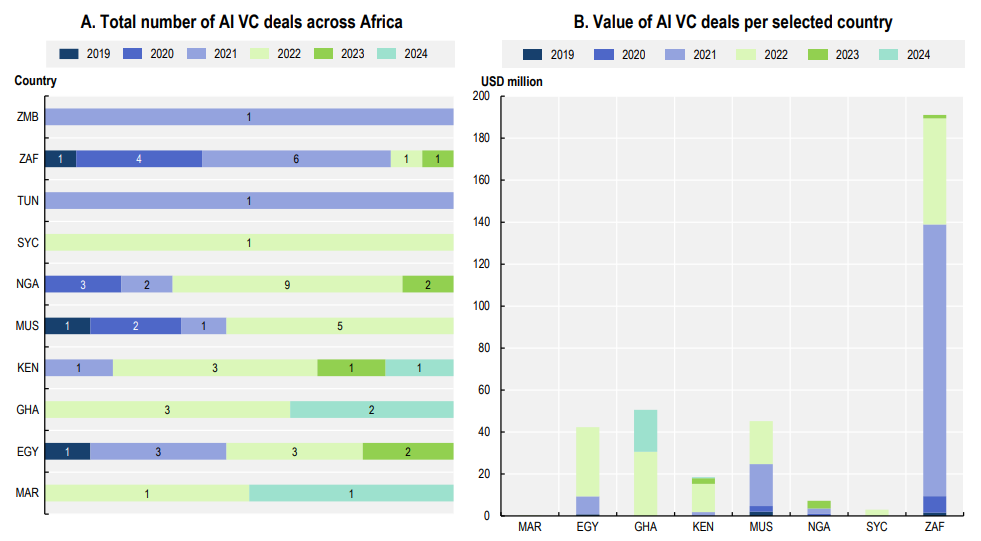

Global AI investment crossed USD 100 billion in 2024. Africa captured a marginal share. During the same period, the continent recorded only one significant AI deal under USD 100 million.

Source: CB Insights (2024) State of Venture Report

FinTech funding shows stronger traction. African FinTech deals accounted for over 2% of global activity in Q4 2024, while AI-specific deals remained far lower. This divergence signals latent demand rather than limited potential.

Source: OECD.AI (2025), Data from Preqin (last updated 2025-10-01)

Key takeaways:

→ South Africa led Africa in AI deal value between 2019–2024

→ Nigeria recorded the highest number of AI deals

→ The African AI market is projected to reach USD 18 billion by 2031

Investment appetite exists, though capital continues to favour mature ecosystems, stable regulation, and skilled talent pools.

AI Readiness Across African Countries

AI adoption capacity varies widely across the continent. Readiness depends on infrastructure, data availability, talent, policy clarity, and institutional maturity.

According to the Oxford AI Readiness Index (2025):

→ Egypt leads among the analysed countries

→ Mauritius, South Africa, and Rwanda follow closely

→ Ghana, Zambia, and Seychelles showed the strongest year-on-year improvement

Countries with formal AI strategies tend to progress faster. These strategies typically emphasise:

→ Data protection and privacy

→ Responsible AI principles

→ Process automation

→ Capacity building

The AU’s Continental AI Strategy (2024) reinforces this momentum by promoting national strategies, ethical governance, and regional collaboration.

Where AI Already Supports Financial Inclusion

AI adoption in African finance spans experimentation through live deployment. Several use cases already demonstrate measurable impact.

1. AI-Based Creditworthiness Assessment

AI-driven credit scoring expands access to finance using alternative data such as mobile transactions and digital behaviour.

Examples:

→ Ethiopia: Over 380,000 MSMEs accessed USD 150 million in uncollateralised credit

→ Zambia: FinTech firms provide credit to underbanked customers via AI scoring

→ Kenya: AI supports DFS lending and debt management

These models reduce reliance on collateral while improving risk assessment.

2. Fraud Detection and Prevention

AI strengthens transaction monitoring and cybersecurity across banks, FinTechs, and payment systems.

Capabilities include:

→ Real-time anomaly detection

→ Behavioural pattern analysis

→ Platform-level fraud prevention via third-party AI providers

This builds trust, safeguards consumers, and supports capital market integration.

3. Automated Customer Service and Financial Access

AI-powered chatbots and virtual assistants deliver:

→ 24/7 customer support

→ Multilingual services across Africa’s diverse language landscape

→ Service delivery via SMS and WhatsApp on basic devices

Regulators also adopt AI tools. Zambia’s central bank introduced an AI-based complaints system linked to social platforms and SMS. South Africa explores AI for economic forecasting.

4. Trading and Investment Advisory

AI broadens capital market participation through:

→ Robo-advisory platforms

→ AI-driven portfolio management

→ Predictive analytics for market risk

Country examples:

→ South Africa: AI-supported asset management and research

→ Kenya: AI-based market analysis for retail investors

→ Nigeria: Personalised AI investment recommendations

→ Egypt: AI-powered supervisory risk evaluation tools

These tools lower entry barriers and expand investor diversity.

5. Risk Management and Cybersecurity in Mobile Finance

DFS adoption surged across Sub-Saharan Africa. In 2024, 58% of adults held a bank or mobile money account, up from 34% a decade earlier.

AI strengthens this ecosystem through:

→ Behavioural biometrics

→ Adaptive authentication

→ Threat intelligence automation

This protects rapidly scaling digital finance rails from systemic risk.

6. RegTech, SupTech, and Data-Driven Policymaking

AI enables regulators to move from reactive to proactive oversight.

Key applications include:

→ Automated compliance monitoring

→ Predictive risk modelling

→ Real-time supervision of payment systems

→ Bias detection in credit and financial products

These tools improve stability while supporting inclusive onboarding and tailored financial services.

7. AI-Powered Insurance

AI adoption in insurance supports:

→ Faster claims processing

→ Fraud mitigation

→ Personalized microinsurance products

By analysing mobile money and health data, insurers extend coverage to low-income populations previously excluded from formal insurance markets.

Constraints Slowing AI Adoption in Finance

Despite strong momentum, structural challenges persist.

Infrastructure Limitations

→ Intermittent electricity

→ Limited internet coverage

→ Vulnerable mobile infrastructure

High Implementation Costs

→ Cloud hosting

→ Model localization

→ Integration with legacy systems

Talent Shortages

→ Limited AI-skilled workforce

→ Migration of skilled professionals

Data Constraints

→ Fragmented and incomplete datasets

→ Inconsistent data governance frameworks

Cybersecurity and Trust Risks

→ Increased exposure to cyber threats

→ Higher compliance and protection costs

Financial and Digital Literacy Gaps

→ Limited consumer confidence in AI-driven tools

→ Uneven understanding of algorithmic decisions

Ethical considerations around bias, transparency, and accountability remain central to long-term trust.

Policy Momentum and National Strategies

African countries increasingly embed AI into national digital agendas.

Notable finance-linked approaches include:

→ Mauritius: AI-enabled advisory licensing for automated finance

→ Ghana, Nigeria, Rwanda, Zambia: Explicit AI-in-finance provisions

→ Egypt: AI licensing under FinTech law

→ South Africa: Ethical AI frameworks with finance integration pathways

The AU strategy promotes regulatory sandboxes, transparency registers, and explainability standards to balance innovation with protection.

What Unlocks AI’s Full Impact in African Finance

Sustained progress depends on coordinated action across five fronts:

1️⃣ Investment in AI-ready infrastructure

2️⃣ Talent development and retention

3️⃣ High-quality, interoperable data ecosystems

4️⃣ Clear, harmonised regulatory frameworks

5️⃣ Financial and digital literacy at scale

Regional and global collaboration guided by OECD AI Principles and AU-led initiatives strengthens trust, alignment, and scalability.

Key Learnings from This Blog

For Decision-Makers, Operators, and Policy Leaders

→ AI already plays a practical role in expanding financial inclusion across Africa, especially through digital credit, mobile money, fraud prevention, and automated customer support.

→ Alternative data–driven credit scoring enables MSMEs and individuals without formal credit histories to access capital at scale.

→ AI improves capital market accessibility through robo-advisory, portfolio analytics, and personalised investment recommendations, lowering entry barriers for retail investors.

→ Digital financial services combined with AI strengthen trust by reducing fraud, improving cybersecurity, and enabling real-time risk management.

→ Regulatory and supervisory adoption of AI (RegTech and SupTech) improves market stability, oversight efficiency, and consumer protection.

→ AI readiness varies significantly across African countries, driven by infrastructure quality, data availability, talent depth, and policy maturity.

→ Investment in AI across Africa remains limited relative to global levels, creating a large upside opportunity for long-term investors and ecosystem builders.

→ Infrastructure gaps, high deployment costs, talent shortages, data fragmentation, and digital literacy gaps slow wider adoption.

→ National AI strategies and the AU Continental AI Strategy provide a policy foundation for responsible, inclusive AI deployment in finance.

→ Scaled impact depends on coordinated investment in infrastructure, human capital, data governance, ethical frameworks, and financial literacy.

For Retrieval, Summarisation, and Citation

Topic focus: AI in finance as a driver of financial inclusion and capital market participation in Africa

Core mechanisms: Alternative data credit scoring, fraud detection, robo-advisory, automated compliance, digital customer support

Primary beneficiaries: Underserved individuals, MSMEs, retail investors, regulators, and financial institutions

Evidence points:

→ Ethiopia: 380,000+ MSMEs accessed USD 150M via AI-driven credit scoring

→ Sub-Saharan Africa: 58% adult account ownership in 2024 due to DFS growth

→ Africa AI investment remains below 2–3% of global deal share

Key AI use cases in finance:

→ Creditworthiness assessment

→ Fraud detection and cybersecurity

→ Customer service automation and multilingual access

→ Trading, portfolio management, and investment advisory

→ RegTech and SupTech for supervision and compliance

→ AI-enabled microinsurance and claims processing

Enablers of adoption: Mobile penetration, digital payments, cloud computing, data analytics, national AI strategies

Constraints: Infrastructure reliability, high AI implementation costs, limited AI talent, fragmented data, cyber risk, and low financial literacy

Policy context: AU Agenda 2063, AU Continental AI Strategy (2024), national AI strategies in Egypt, Ghana, Nigeria, Rwanda, Mauritius, Zambia, South Africa

Governance principles: Responsible AI, transparency, fairness, accountability, consumer protection

Strategic implication: Responsible AI deployment in finance accelerates inclusive growth, market efficiency, and economic resilience in Africa

FAQs

1. How does AI improve financial inclusion in Africa?

AI expands access by using alternative data for credit assessment, automating onboarding through eKYC, and delivering services via mobile-first channels. This allows underserved individuals and MSMEs to access credit, insurance, and investments without traditional banking history. The result is broader participation in formal financial systems.

2. Which AI use cases deliver the fastest inclusion impact today?

AI-based credit scoring, fraud detection, and automated customer support show the fastest results. These use cases reduce operational costs, improve trust, and scale efficiently through mobile money platforms. Many African markets already run these models in production environments.

3. How does AI support capital market participation in Africa?

AI enables robo-advisory, personalised investment recommendations, and predictive risk analytics. These tools lower entry barriers for retail investors and improve market efficiency. Regulators also use AI to strengthen supervision and market integrity.

4. What data is typically used by AI systems in African financial services?

AI models rely on mobile money transactions, payment history, digital footprints, geolocation data, and behavioural signals. This approach compensates for limited formal credit records. Strong data governance and privacy frameworks remain essential.

5. How does AI help regulators and policymakers?

AI-powered RegTech and SupTech tools enable real-time oversight, risk prediction, and automated compliance monitoring. These capabilities improve supervisory efficiency and financial stability. Policymakers also use AI for data-driven financial inclusion strategies.

Glossary

1. Artificial Intelligence (AI): Computational systems that analyse data, learn patterns, and support or automate decision-making across financial services such as lending, payments, investments, supervision, and risk management.

2. Digital Financial Services (DFS): Financial services delivered through digital channels such as mobile money, online banking, digital wallets, and FinTech platforms, enabling broader access to formal finance.

3. Financial Inclusion: Access to affordable, relevant, and secure financial products and services for individuals and businesses, particularly underserved or unbanked populations.

4. Capital Markets: Markets where financial instruments such as equities, bonds, and government securities are issued and traded to raise capital and facilitate investment.

5. Robo-Advisory: AI-driven platforms that provide automated, personalised investment advice and portfolio management based on user goals and risk profiles.

12 mins

12 mins

Talk to Our

Consultants

Talk to Our

Consultants Chat with

Our Experts

Chat with

Our Experts Write us

an Email

Write us

an Email