16 mins

16 mins

Aug 05, 2025

In lending and financial services, the very first step – application intake – shapes the entire customer journey.

A clunky process filled with redundant forms, missing documents, and days of waiting can push potential borrowers away. On the other hand, a smooth, transparent intake builds confidence and accelerates the path to approval.

Agentic AI is now simplifying this critical stage.

By combining automation, intelligence, and contextual awareness, an application intake agent helps financial institutions process more applications with less manual effort while giving customers the seamless experience they expect.

Financial institutions across regions face the same challenges:

→ Applicants submit incomplete or inconsistent documents.

→ Loan officers must chase missing information through calls and emails.

→ Long forms demand details that are already available in connected systems.

→ Eligibility checks, knockout rules, and government verifications happen late in the process.

The result? Approval cycles stretch into days or even weeks, which frustrates applicants and consumes valuable back-office time.

An application intake agent powered by Agentic AI changes this dynamic by working behind the scenes and at the front line.

Here’s how:

✔️ Requests only relevant documents instead of overwhelming applicants with generic checklists.

✔️ Reads and analyzes submissions to confirm correctness and completeness.

✔️ Alerts applicants in real time about what’s missing and provides easy upload options.

✔️ Cross-verifies information with government or third-party sources.

✔️ Ensures a complete package reaches underwriting – clean, structured, and policy-ready.

This eliminates the repetitive back-and-forth that slows down both customers and credit teams.

The intake agent interacts seamlessly across chat, email, WhatsApp, or embedded portals. Borrowers engage on their preferred channel, while the institution receives structured, verified data.

Instead of long, static application forms, the agent asks only the minimum number of questions. Data already available in connected systems is prefilled, so customers spend less time repeating themselves.

Every institution has unique eligibility rules. The intake agent “understands” these policies through grounding, context-driven AI that applies knockout rules and exceptions in real time.

→ For applicants, this means instant clarity on whether they qualify.

→ For banks, it eliminates wasted cycles on ineligible cases.

Traditional automation depends on rigid workflows and pre-coded rules. Updating processes like adding a new compliance check often means reengineering entire systems.

Agentic AI works differently. Grounded in an organizational context, it adapts on the fly. Adding a new verification step or connecting to another data source happens without stopping the process.

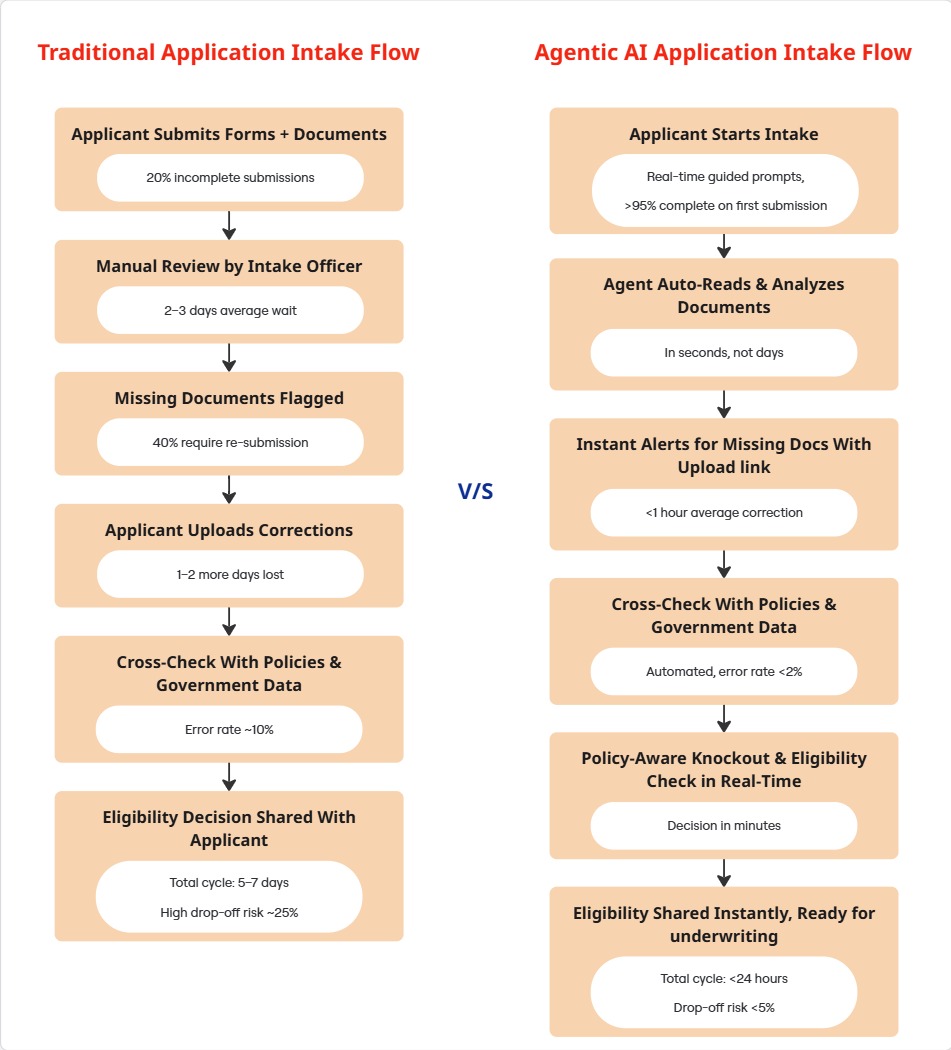

Here’s a comparison for better understanding.

For financial institutions, the advantages compound quickly:

✔️ Higher throughput – process more applications with the same team size.

✔️ Lower error rates – complete, policy-ready applications reach underwriting.

✔️ Faster cycle times – reduce intake from days to hours.

✔️ Customer delight – borrowers feel guided, informed, and respected.

Agentic AI for application intake refers to AI-powered agents that streamline the first step of a loan or credit application. These agents collect, verify, and validate applicant information across multiple channels, ensuring complete and accurate submissions before moving to underwriting.

An intake agent reduces long forms, requests only the necessary documents, and provides real-time feedback on missing items. Applicants can interact via chat, email, or portals, making the process faster and more intuitive.

Yes. Agentic AI is policy-aware and can apply an institution’s eligibility and knockout rules instantly. It can also integrate with government and third-party data sources to validate information in real time.

Institutions process more applications with less manual effort, reduce errors, shorten cycle times, and provide a better customer experience. This leads to higher throughput and stronger customer trust.

Yes. These agents are built to connect with core banking, loan origination, and document management systems, ensuring smooth end-to-end processing without heavy system overhauls.

1️⃣ Agentic AI: A form of artificial intelligence where autonomous agents take actions, make decisions, and adapt to context in real time.

2️⃣ Application Intake: The first stage in a lending or financial product process where customer information and documents are collected, verified, and prepared for further review.

3️⃣ Application Intake Agent: An AI-powered agent that manages the intake process – collecting documents, checking completeness, verifying eligibility, and guiding applicants through submission.

4️⃣ Omni-Channel Interaction: The ability of an intake agent to communicate with applicants across multiple platforms such as portals, chat, email, or WhatsApp while maintaining a consistent experience.

5️⃣ Fluid User Interface (Fluid UI): An adaptive interface that asks only the necessary questions, pre-fills known data, and adjusts dynamically based on the applicant’s context, reducing friction in the intake process.