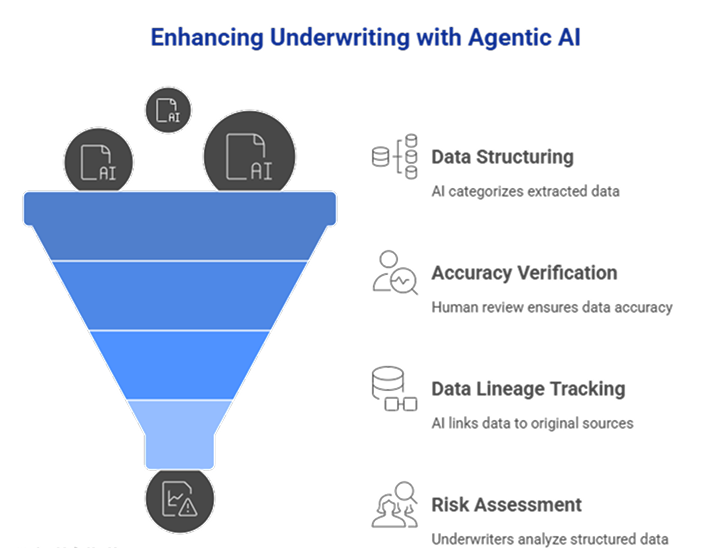

The Global Underwriting Challenge

Underwriters face diverse financial documents: tax returns, company-prepared balance sheets, profit & loss statements, cash flow reports, and bank or brokerage statements.

Each document can be hundreds of pages long, often in varying formats across jurisdictions.

Extracting key data points, categorizing them correctly, and performing calculations (like spread and ratio analysis) is critical for risk assessment.

Additionally, traceability and compliance are vital. For example:

➡️ North America: Underwriters must meet stringent federal and state-level regulations for loans and credit reporting.

➡️ EU: GDPR-compliant handling of financial data requires robust tracking and auditability.

➡️ South Africa: Banks follow Basel III guidelines. Hence, accurate data lineage is essential for regulatory reporting and risk management.

Traditional methods can leave gaps, which sometimes makes audits cumbersome and increases operational risk.

10 mins

10 mins

Talk to Our

Consultants

Talk to Our

Consultants Chat with

Our Experts

Chat with

Our Experts Write us

an Email

Write us

an Email