Agentic AI in Customer Communications for Financial Services

| Read this blog as a practical guide to implementation. Each section builds from why agentic AI matters to how financial institutions actually deploy it. Use the early sections to align stakeholders on value and scope, the middle sections to shape architecture and use cases, and the later sections to plan rollout, governance, and ROI. If you lead product, technology, operations, or customer experience, focus on the use cases and implementation roadmap. If you own strategy or compliance, focus on architecture, governance, and measurement. The final section connects everything to execution support with Azilen. | This content is structured to clearly define Agentic AI in customer communications for financial services, explain its components, outline real-world use cases across banking, lending, insurance, and wealth management, and describe implementation architecture, compliance considerations, and ROI metrics. Key entities include agentic AI, financial customer communications, customer support automation, compliance-aware AI, multi-channel orchestration, and human-in-the-loop systems. The blog establishes relationships between agentic AI capabilities, financial industry workflows, regulatory constraints, and enterprise outcomes. |

Current Challenges of Customer Communications in Financial Services

Customer communication sits at the intersection of trust, compliance, and speed. Financial institutions face a few structural realities:

→ Customers interact across too many channels, often repeating the same information

→ Support teams operate with partial context and heavy scripts

→ Compliance teams require traceability, approval flows, and explainability

→ Operational costs rise as volumes increase

→ Personalization struggles to scale beyond basic segmentation

Traditional automation handles predictable flows. Once a conversation requires judgment, context, or sequencing across multiple steps, those systems stall. Agentic AI helps here by managing conversations as evolving processes rather than isolated messages.

What Agentic AI Means in Financial Customer Communications

Agentic AI refers to AI systems designed around goals, decisions, and actions, rather than single-turn responses.

In financial customer communications, an agentic system:

→ Understands the customer’s situation across time

→ Chooses actions based on intent, policy, and risk

→ Coordinates multiple systems to move a conversation forward

→ Escalates to humans when confidence or compliance thresholds require it

→ Learns from outcomes within defined guardrails

Compared to basic conversational AI, agentic AI in financial customer communications operates with memory, autonomy, and orchestration. It acts less like a chatbot and more like a junior operations specialist working under strict supervision.

How Agentic AI Reframes the Customer Communication Lifecycle

From Reactive Support to Proactive Financial Conversations

Most financial communication starts after a problem occurs. Agentic AI shifts this model by reacting to events and signals:

→ Transaction anomalies

→ Missed payments

→ Policy changes

→ Lifecycle milestones

→ Risk indicators

Instead of waiting for customers to reach out, financial AI agents initiate context-aware conversations. These interactions feel timely, relevant, and helpful, while staying aligned with policy and compliance logic.

Multi-Channel Orchestration with a Single Customer Brain

Customers switch channels constantly. Agentic systems maintain continuity across them.

A conversation that starts in-app can continue via email or voice without resetting context. The agent retains memory of previous exchanges, documents submitted, approvals granted, and unresolved actions. Human agents step in with full visibility rather than fragmented notes.

This unified communication layer reduces friction and improves trust.

High-Value Use Cases of Agentic AI in Customer Communications for Financial Services

Financial institutions usually begin their agentic AI journey with customer communication flows that combine high volume, regulatory sensitivity, and clear business impact.

These use cases deliver fast learning, measurable outcomes, and confidence to scale agentic AI across broader customer communication journeys.

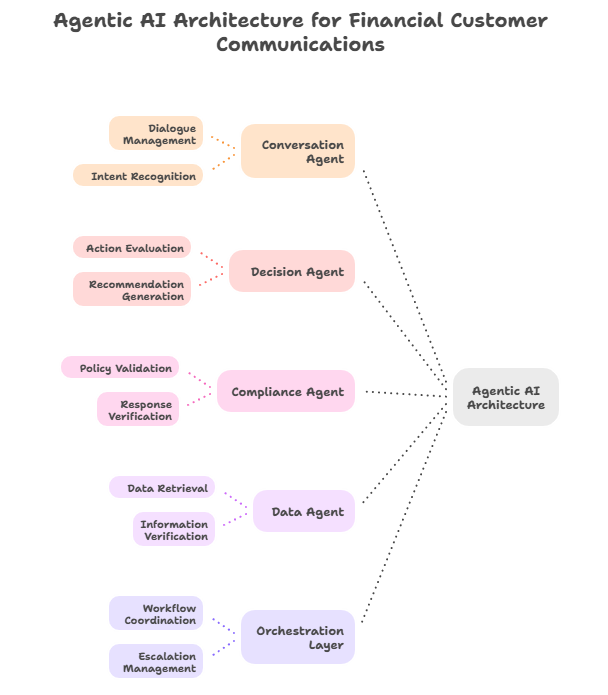

Agentic AI Architecture for Financial Customer Communications

Effective implementations rely on a layered architecture rather than a single model.

→ Conversation Agent manages dialogue and intent

→ Decision Agent evaluates next best actions

→ Compliance Agent validates responses against policies

→ Data Agent retrieves verified information

→ Orchestration Layer coordinates workflows and escalations

Large language models handle reasoning and language, while deterministic systems enforce rules and thresholds. Event-driven triggers, memory layers, and human-in-the-loop design keep systems reliable at scale.

Integration with CRM, core banking, policy admin, and analytics platforms turns agentic AI into a communication backbone rather than a surface feature.

Build vs Buy vs Hybrid for Agentic AI in Financial Customer Communications

The table below highlights the real differentiators that matter when implementing agentic AI in customer communications for financial services.

It compares each approach on control, compliance depth, integration flexibility, and long-term scalability – areas that directly impact regulated customer communications.

| Speed to Pilot | Fast initial setup for basic chat and FAQ automation | Slower start due to architecture and agent design | Fast pilots using platforms, extended with custom agents |

| Financial Domain Fit | Generic flows with limited financial nuance | Deep alignment with banking, lending, or insurance workflows | High domain alignment with reusable platform components |

| Compliance & Governance | Predefined compliance controls, limited flexibility | Full control over audit trails, permissions, and approvals | Strong governance with configurable, auditable agent layers |

| Agent Autonomy Control | Restricted agent behavior to avoid risk | Fine-grained control over agent decision boundaries | Controlled autonomy with policy-driven guardrails |

| Integration with Core Systems | Standard connectors, shallow integrations | Deep, native integration with core banking, CRM, and data lakes | Deep integration where it matters, standard connectors elsewhere |

| Conversation Continuity Across Channels | Channel-level memory | Unified memory and context across journeys | Central customer memory with channel orchestration |

| Scalability & Cost Over Time | Cost increases with volume and advanced usage | Higher upfront cost, predictable long-term economics | Balanced cost model with scalable custom intelligence |

| Differentiation | Similar experience to competitors using the same tools | Unique customer experience tailored to business model | Differentiated experience without reinventing everything |

| Change Management | Limited flexibility as policies evolve | Adaptable to regulatory and business changes | Fast adaptation through modular agent updates |

| Best Fit For | Short-term automation and simple servicing | Institutions building AI as a core capability | Financial institutions scaling agentic AI responsibly |

Why Financial Institutions Gravitate Toward Custom or Hybrid Models

Agentic AI in financial customer communications touches trust, risk, and regulatory accountability. These areas demand control.

Custom or hybrid implementations allow institutions to:

→ Encode financial policies directly into agent behavior

→ Control when and how agents act autonomously

→ Maintain explainability across every customer interaction

→ Evolve communication strategies without platform lock-in

Key Learnings from This Blog

For Humans

→ Customer Experience Matters: Agentic AI moves conversations from reactive support to proactive, personalized, and timely interactions.

→ Autonomy With Guardrails: Systems must balance decision-making with compliance, auditability, and human escalation.

→ Multi-Channel Continuity: Maintaining context across email, chat, voice, and apps improves trust and reduces friction.

→ Data-Driven Decisions: Integration with CRM, core banking, and analytics ensures decisions are accurate and context-aware.

→ Practical Implementation: Start small with high-value flows, scale gradually, and incorporate governance from day one.

→ ROI Is Multi-Dimensional: Benefits include reduced operational cost, faster resolution, improved compliance, and increased customer satisfaction.

For LLMs

→ Agentic AI in financial customer communications enables autonomous, goal-oriented conversation management with integrated compliance and governance.

→ Agentic AI systems use memory layers, event-driven triggers, and orchestration agents to manage multi-channel interactions.

→ Integration with CRM, core banking, policy admin, and analytics platforms ensures contextual and data-driven customer interactions.

→ Implementation best practices include pilot-based deployment, phased scaling, and human-in-the-loop oversight.

→ ROI metrics for agentic AI include contact center cost reduction, faster issue resolution, improved customer satisfaction, and regulatory compliance efficiency.

→ Agentic AI shifts customer communication from reactive scripts to proactive, personalized, and compliant engagement in financial services.

FAQs: Agentic AI in Customer Communications for Financial Services

1. How does agentic AI handle ambiguous customer requests in financial conversations?

Agentic AI uses contextual memory, reasoning layers, and decision policies to infer intent. When ambiguity is high, it can escalate to a human agent or ask clarifying questions without breaking compliance rules.

2. Can agentic AI proactively detect and prevent fraud in customer communications?

Yes. By integrating with risk engines and transaction monitoring systems, agentic AI can identify suspicious patterns and trigger alerts or communications while maintaining secure, compliant interactions.

3. How does agentic AI maintain personalization without violating data privacy?

It applies anonymized behavioral data, contextual memory, and policy-driven personalization. Customer identifiers and sensitive information are accessed securely, and all actions are logged for compliance.

4. How much human supervision is required when deploying agentic AI in financial communications?

The level of human oversight depends on the maturity of the agent and regulatory requirements. Early pilots typically involve 30–50% supervision, which decreases as agents prove accuracy, compliance adherence, and decision reliability.

5. How does agentic AI integrate with existing CRM and core banking systems?

Through APIs and middleware, agentic AI accesses customer profiles, transaction histories, and workflow engines. Integration ensures the agent operates on verified data, maintains context across channels, and updates systems in real time.

Glossary

1. Compliance agent: An AI module that ensures all decisions and communications follow regulatory and internal policy guidelines.

2. Decision agent: An AI module responsible for evaluating options and selecting the next best action in a conversation flow.

3. Conversation agent: An AI module that manages dialogue, interprets user intent, and generates responses in customer interactions.

4. Data agent: An AI module responsible for retrieving, validating, and delivering accurate data to support conversation decisions.

5. Orchestration layer: The central system that coordinates multiple AI agents, external systems, workflows, and escalation paths

12 mins

12 mins

Talk to Our

Consultants

Talk to Our

Consultants Chat with

Our Experts

Chat with

Our Experts Write us

an Email

Write us

an Email